Financial Return Calculator Tutorial

Tutorial

When to use this tool

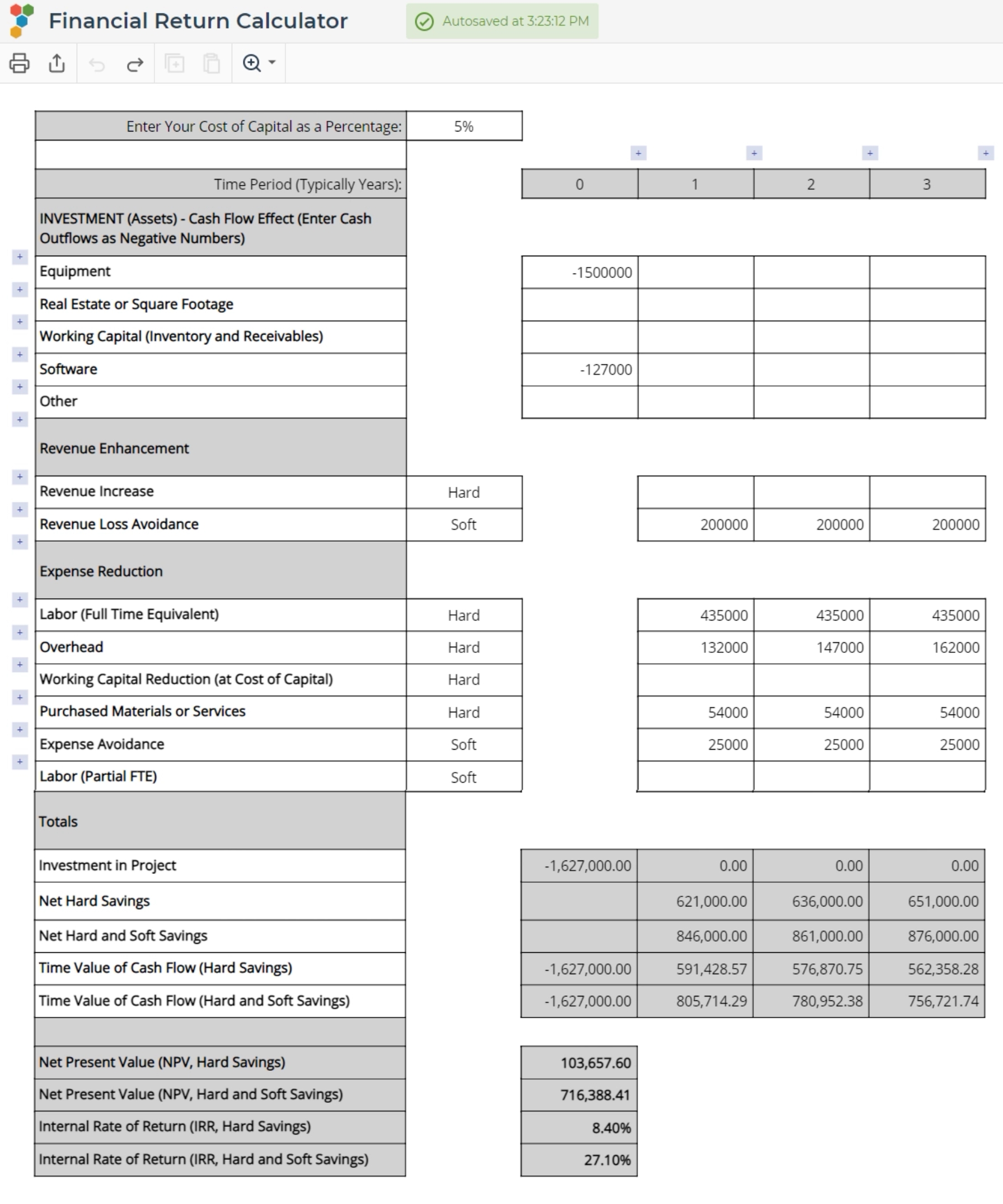

Use the Financial Return Calculator to determine the Net Present Value and Internal Rate of Return for a potential project, and as an analysis tool to decide amongst project alternatives. Once a project is selected, the calculator can be used on a regular basis to assess the projected return of the project. It will serve as an early warning device for projected savings that fall below expectations. This early warning will give the project team more time to identify and implement corrective actions.

How to use this tool in EngineRoom

- Select Financial Return Calculator from Define in the DMAIC menu or Planning in the Standard menu.

- Start by entering your Cost of Capital. Enter 10 for 10%, 5 for 5%, etc. (Do not enter the % sign)

- Enter investments your project will require in the INVESTMENT section. Enter these investments as negative numbers, as they represent cash outflow.

- Enter revenue improvements in the Revenue Enhancement section, categorized as Hard for revenue increase and Soft for loss avoidance. Enter these values as positive numbers as they are cash increases.

- Enter the amount of reduction in expenses achieved through the project in the Expense Reduction section. Enter cost increases as negative numbers and cost decreases as positive numbers to indicate the amount of reduction in expenses.

- Repeat these entries for future years of investment and expenses as necessary, and those values will be used as part of the calculations at the bottom of the template.

Notes:

- The results include the total investment, Net Savings (hard benefits only and all benefits), the time value of cash flows, the Net Present Value of the cash flows, and the internal rate of return of the investment.

- These numbers apply to a particular project. Running similar calculations with other projects in additional Financial Return Calculators can help prioritize those projects.

An example of Financial Return Calculator output is shown below:

Was this helpful?